If you’re looking to maximize IMB value for acquisition, read on!

The Unexpected IMB Value Engine

Traditional automation cuts costs, but that’s not the only driver of IMB value. Not to be confused with Agents, smart AI digital workers become part of the balance sheet … digital employees that generate IP, not just output.

When underwriting prep, data extraction, borrower communications, and VOEs & VOIs are handled by AI workers, those workflows turn into scalable, high-value assets.

That’s the game-changer: IMB value grows not just from what you sell, but from who (or what) builds it.

Why IP Matters

Buyers pay more for businesses with scalable, efficient, and defensible systems, especially when the underlying IP can be propagated across other business units, creating enterprise-wide leverage.

An AI Workforce encodes your workflows, decision-making, and data into reusable, ownable IP. These digital employees can be scaled, cloned, and valued like any asset on your balance sheet.

Outsourcing Tech Expertise? Think Twice.

Relying on SaaS or vendor platforms doesn’t create owned IP, nor the compounding enterprise value that comes with it.

For IMBs planning an exit, owning your technical expertise creates long‑term enterprise value. Arguably, the greater long‑term value lies in being a platform, a shift that inspired the term “fintech lender.” The capabilities you build internally with AI Workers evolve into proprietary IP, scalable, repeatable, and defensible, which makes your business more attractive to strategic buyers.

Today, that old “buy vs. build” calculus has been flipped on its head. AI has erased the cost and speed barriers that once made SaaS the only viable option for speed to market. What was once too expensive or too complex is now both feasible and a strategic differentiator.

In an era where software can write itself and AI can operate as an end‑to‑end SDLC team, renting your tech expertise no longer makes sense when you can build, own, and monetize it instead.

Insights from IMB CEO Steve Majerus on the Rocket-Redfin Deal

What IMB Value Means in M&A Deals

When it comes to mergers and acquisitions, IMB Value is about much more than just loan production numbers. Traditional metrics often miss the mark because the real value lies in how efficiently and reliably a business operates [1].

For buyers assessing IMBs, one question stands out: Can this business consistently generate profits without requiring constant oversight? The response to this question plays a huge role in determining whether you’ll secure a premium valuation or settle for the industry average. Understanding what drives these valuations is critical if you want to turn your IMB into a strong, scalable platform.

What Drives IMB Value in M&A

Buyers focus on four main factors when deciding how much to pay for an IMB: scalability, operational efficiency, defensibility, and repeatability. These are the elements that can transform a mortgage business from a risky investment into a valuable, scalable platform.

- Scalability refers to the ability to grow without a matching increase in costs.

- Operational efficiency is reflected in profit margins. For instance, in 2020, lenders achieved record profit margins exceeding 100 basis points, compared to an average of 40 basis points in 2019 [3].

- Defensibility protects your market position through proprietary technology, unique relationships, or processes that create barriers for competitors.

- Repeatability ensures that standardized, well-documented processes deliver predictable and transferable cash flows.

When these four elements are optimized, they significantly boost IMB Value, turning a business into a platform buyers are eager to invest in.

"Buyers are willing to buy at a higher valuation because the entire market benefits from production momentum and because they see a multiple in the value they can add, albeit with stronger technology, better capital markets execution or consolidation savings."

- Garth Graham, STRATMOR Group Senior Partner [3][5]

Technology is a key factor in this equation. Companies with strong tech infrastructures that support scalability, efficiency, defensibility, and repeatability often command higher multiples. It’s worth noting that equity investors and public companies now hold stakes in 17 of the top 25 IMBs, representing over 40% of the total IMB market origination volume [3].

Why Traditional IMB Models Get Lower Valuations

On the flip side, traditional IMB models often fall short in these areas, leading to lower valuations. Many of these businesses are seen as “people-heavy” and “process-fragile,” two characteristics that make them less attractive to buyers.

- People-heavy operations rely too much on key individuals to handle critical tasks. If underwriting, processing, or client relationships are tied to specific employees, buyers worry about retention after the deal closes, which can erode the company’s value.

- Process-fragile systems lack the standardization, automation, or documentation needed for consistent performance. When processes depend on individuals instead of established systems, buyers see higher risks and potential integration headaches.

"If you can’t make a reasonable profit for the risk, it’s time to think about joining another firm or selling your company. But you don’t want to be in a position where you have to sell."

Integration challenges are also a major concern for buyers. According to Harvard Business Review, 70–90% of deals fail during the post-merger integration phase [2]. This makes buyers wary of businesses that seem difficult to integrate smoothly, leading to discounted valuations.

Market conditions further highlight these differences. When the market is in, efficient platforms can scale quickly and capture volume, ensuring no loans slip through the cracks, while traditional, high‑cost models struggle to compete. (Remember 2020?)

The key is shifting from labor-dependent to system-dependent operations. This means investing in intellectual property and creating processes that don’t rely on specific individuals. Businesses that make this shift position themselves as platforms, which can command much higher valuations in M&A deals.

AI Workers: The Hidden Tool for Higher IMB Value

AI Workers are changing the game for IMBs, offering a new way to handle essential operational tasks. These aren’t your typical automation tools – they’re advanced digital agents capable of managing underwriting prep, document follow-ups, and conditions tracking. More importantly, they integrate into workflows, creating scalable systems that buyers see as valuable intellectual assets.

What sets AI Workers apart is their ability to handle tasks that traditionally require human judgment. They can process documents, verify information, track loan conditions, and even communicate with borrowers. Plus, thanks to machine learning, they get better at their tasks over time.

"Very few roles will be completely replaced… most roles will evolve to incorporate AI in ways that augment human capabilities."

– Nickle LaMoreaux, IBM‘s Chief Human Resources Officer [8]

The real advantage for IMBs? AI Workers not only cut costs today but also build intellectual property that can command a premium price during acquisitions.

Reducing IMB Risk with AI Workers

One of the biggest concerns for buyers is key person risk – the fear that critical employees might leave after an acquisition, taking their expertise with them. AI Workers address this issue by capturing and preserving institutional knowledge in digital form.

As employees train AI Workers to perform their tasks, their expertise is documented and retained. This ensures process continuity, even if key personnel leave. For buyers, this is a major reassurance, as it guarantees that operations can continue smoothly without disruptions.

AI Workers also reduce compliance risks. Unlike humans, who might interpret rules differently or make mistakes under pressure, AI Workers consistently apply lending guidelines and regulatory requirements. This uniformity minimizes the chances of compliance errors, further enhancing buyer confidence.

By mitigating risks and ensuring operational stability, AI Workers make your IMB a more attractive acquisition target.

Building Consistent, Scalable Processes

AI Workers don’t just enhance efficiency – they also bring consistency to operations. Predictable processes are crucial for buyer confidence, and AI Workers excel at delivering reliable results. Unlike human-dependent operations, which can vary, AI Workers provide outcomes that are easy to model and forecast.

This predictability often results in higher valuation multiples. When buyers can trust that your operations will perform consistently under different conditions, they’re more likely to pay a premium for your business. AI Workers also demonstrate scalability, as they can handle volume spikes without any drop in performance, showing that your platform can grow without a proportional increase in costs.

Another advantage is the creation of standardized workflows. These workflows are well-documented and easy to transfer to an acquiring company. Instead of inheriting a patchwork of processes, buyers receive a systematized approach that can be implemented across their organization.

The "Future of Jobs Report 2023" predicts that AI will automate 43% of work tasks by 2027 [9]. By adopting AI Workers now, you’re positioning your IMB as a forward-thinking, technology-driven operation ready for the future of mortgage lending.

Best Automation Opportunities for IMBs

IMBs can enhance their value by automating key processes that improve efficiency, ensure compliance, and enhance the borrower experience. By converting time-consuming tasks into automated workflows, IMBs can turn traditional cost centers into operational strengths.

The business process automation market is expected to grow to $19.6 billion by 2026 [10]. For mortgage companies, embracing this trend strategically can provide a meaningful competitive edge, especially when focusing on processes that add value for potential buyers.

Which Mortgage Origination Processes to Automate First

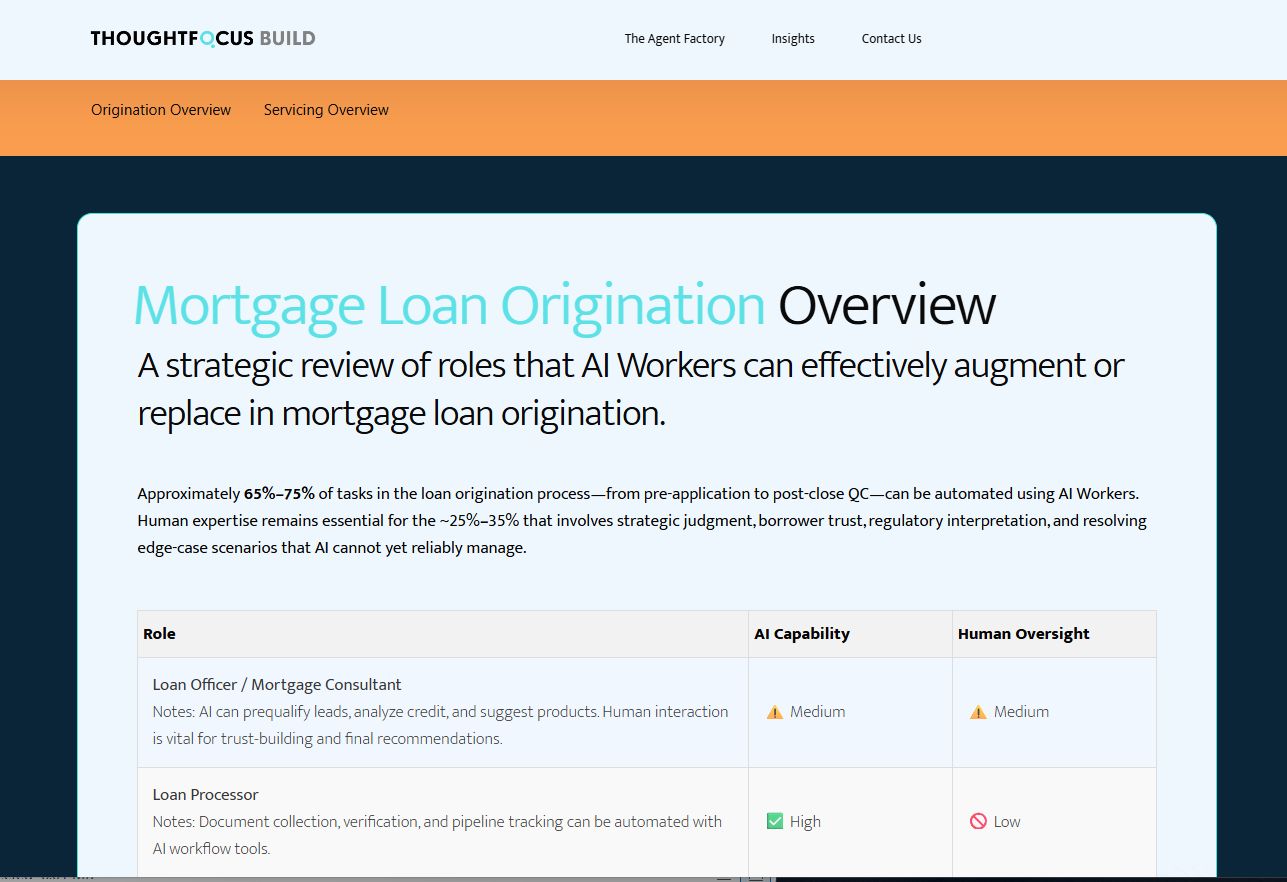

ThoughtFocus Build offers a chart for mortgage originators that maps the evolving boundaries of human vs. machine work, highlighting what’s already possible today. p.s. There’s also a section for Servicers.

ThoughtFocus Build Website

As you can see, some processes in the mortgage lifecycle are particularly suited for automation. And, as we’ve seen over the last five years, some workflows are more difficult than others.

Yet, a handful of lenders have quietly put many automations in place using AI Workers on the workflows listed below.

- Pre-close audits: These audits often require meticulous manual reviews of loan files, document verification, and regulatory checks. AI-driven systems can streamline this by identifying missing documents, verifying compliance, and flagging issues, minimizing last-minute delays and errors.

- Trailing documentation: Post-closing, IMBs often spend significant time tracking down missing documents. Automation tools can monitor outstanding items, send reminders, and escalate follow-ups, ensuring deadlines are met without manual oversight.

- Servicing onboarding: The transfer of loans to servicers involves extensive documentation and data validation. AI can prepare complete servicing packages, confirm data accuracy, and ensure all compliance requirements are met, speeding up the process and improving cash flow.

- Borrower communication triggers: Keeping borrowers informed throughout the loan process is critical. Automation can send personalized updates about application status, document needs, and closing timelines, reducing the workload for loan officers while improving the borrower experience.

- Conditions clearing: Underwriter conditions must be resolved before closing, a process that can be tedious and prone to errors when done manually. Automated systems can track condition statuses, request necessary documents, and provide real-time updates to stakeholders, ensuring no details are overlooked.

sbb-itb-5f0736d

Creating IP That Buyers Want to Pay For

The value of high-stakes acquisitions often comes down to what buyers are purchasing. When AI Workers take over tasks traditionally handled by humans, labor costs and risks are transformed into scalable intellectual property (IP). This shift not only lowers expenses but also enhances your IMB Value by creating a scalable, enduring asset that appeals to buyers.

Turning Costs into Scalable Assets

In many traditional IMB operations, manual processes lead to recurring costs without building lasting value. For instance, loan officers spend around 40% of their time on manual data entry and analysis tasks. These labor costs don’t translate into reusable business assets – they’re essentially sunk costs.

AI Workers change this equation by turning routine tasks into scalable, reusable infrastructure. When an AI Worker learns to handle tasks like processing loan documents, managing borrower communications, or tracking compliance requirements, it creates IP that stays with the business. Unlike human expertise that can leave when employees move on, AI-driven processes remain in place and improve over time.

Mortgage workflow automation can streamline up to 80% of processes. This transformation turns what were once recurring labor expenses into durable IP assets. AI document automation, for instance, can cut processing time by up to 70% while also improving data accuracy. For buyers, these capabilities aren’t just about saving time – they represent proprietary technology that provides a competitive edge. These scalable assets are what justify higher valuations.

Why Buyers Pay More for IP-Rich Platforms

AI Workers don’t just improve efficiency – they also create IP-rich platforms that buyers find highly attractive. These platforms offer predictable scalability and reduced risk, two qualities that drive premium valuations in acquisitions.

Predictable scalability is a major selling point. With AI Workers handling underwriting, document processing, and borrower communications, businesses can scale operations without needing to hire or train additional staff. For example, one mortgage firm using AI for underwriting reported a 50% reduction in decision-making time while maintaining or even improving the accuracy of risk assessments [17]. This efficiency allows businesses to capitalize on market opportunities without the usual operational headaches.

Another key factor is reduced integration risk. When essential processes rely on specific employees, acquisitions carry the risk of losing institutional knowledge if those employees leave. AI Workers mitigate this concern by embedding that knowledge into systems.

"If you took the time to make sure that you have fully verifiable confidence in what you’re doing [with AI]…it’s almost like talking to a human because you can show the logic behind exactly what that modeling did… Everything creates a paper trail.” [14]. Jason Bressler, CTO at United Wholesale Mortgage

Regulatory compliance is another area where AI shines. For example, AREAL.ai uses AI to automate compliance reporting and ensure lending practices meet evolving regulations [15]. By continuously monitoring transactions and flagging anomalies, these systems help businesses stay compliant with rules like those governing anti-money laundering. This systematic approach reduces post-acquisition regulatory risks – a critical factor in the heavily regulated mortgage industry.

Looking at the Data

The numbers speak for themselves. Companies adopting comprehensive AI-driven transformation strategies report a 35–45% reduction in loan processing times, a 30–40% drop in underwriting costs, a 50–65% improvement in data accuracy, and the ability to handle 2–3× volume fluctuations without increasing staff [17]. These metrics highlight the operational leverage that makes IP-rich platforms so attractive to buyers.

Timing also plays a role. The global market for AI in financial services was valued at $20 billion in 2022 and is projected to exceed $100 billion by 2032, with a compound annual growth rate (CAGR) of 20% [16]. Buyers understand that AI capabilities are quickly becoming essential in the mortgage industry, making investments in AI Workers more valuable than ever.

When evaluating your business, buyers are looking for assets that will continue to generate value long after the acquisition. AI Workers trained in your specific workflows, compliance needs, and customer interactions represent the kind of enduring IP that drives higher valuations. Unlike traditional tech solutions with ongoing licensing fees, trained AI Workers become permanent assets – they get better with time and scale effortlessly to meet growing demand.

How to Start Using AI Workforce Solutions

You don’t need to completely overhaul your systems to begin using AI Workers. Start small – focus on a single, impactful process. This step-by-step approach allows you to integrate AI into your operations while seeing immediate results that can justify further investment.

Begin with One Process

The best way to start is by identifying one high-impact process that AI can handle effectively. By perfecting this single use case, you’ll gain valuable insights into how AI Workers fit into your operations and deliver quick results. This also sets the stage for building scalable intellectual property.

Loan pre-qualification is an excellent starting point. AI Workers can analyze borrower data, such as income, credit score, and DTI, to determine eligibility. Since this process is rules-based and repetitive, it’s a perfect fit for AI automation.

"If you want to know what’s ripe for disruption from AI, it’s docs, voice and data.", says Sean Grzebin, CEO of Chase Home Lending [18] .

Work with Your Current Technology

Modern AI workforce solutions are designed to integrate seamlessly with your existing systems, such as loan origination systems (LOS) and servicing platforms, through APIs. This approach enhances your current technology without requiring a full system replacement.

An API-first strategy allows AI to work within your existing LOS, preserving your investment in familiar tools while adding new capabilities. For example, ThoughtFocus Build specializes in connecting AI Workers to systems like LOS, CRM platforms, and compliance tools. This way, your workflows stay intact while gaining the benefits of automation.

Compliance automation is another area where AI can integrate without disruption. AI Workers can process internal guidelines and regulations to ensure compliance, working alongside existing tools to add an extra layer of automated oversight.

Adoption Rates Remain Low

Despite the potential, adoption remains low. According to a Fannie Mae Mortgage Lender Sentiment Survey from October 2023, only 7% of mortgage lenders currently use generative AI, while 71% are either just starting to explore it or not considering it at all [13]. However, 73% of lenders believe generative AI can boost operational efficiency [13].

"Lenders can explore and invest in GenAI capabilities starting with use cases that have already shown a significant positive impact in other industries. Starting on a small scale allows lenders to identify immediate gains, thereby providing a valuable learning experience", explains Aditya Swaminathan, EY Americas Consumer Lending and Mortgage Leader [13].

This method of integrating AI into your existing systems helps you align automation efforts with your business goals, including any planned exit strategies.

Match Automation to Your Exit Timeline

If you’re planning to exit your business within the next 18–36 months, your AI implementation should align with that timeline. The goal isn’t just operational efficiency – it’s building valuable intellectual property that will appeal to potential buyers during due diligence.

To prepare, work backward from your exit date. Focus on processes that can quickly deliver measurable improvements in processing speed, cost savings, and risk reduction. For example, demonstrating consistent AI performance over 12–18 months can significantly enhance your valuation.

Prioritize processes that show clear ROI and build a roadmap for scaling automation. Start with straightforward tasks that yield quick wins, then move on to more complex automations that deepen your competitive edge. Keep detailed records – buyers will want to see how your AI Workers operate, learn, and improve over time.

The ultimate goal is to craft a compelling narrative for buyers. When you can show that AI Workers have reduced your cost per loan while improving speed and compliance accuracy, you’re not just offering a mortgage business – you’re presenting a tech-enabled platform with built-in advantages. This makes your business far more attractive to potential buyers.

Conclusion: Sell as a Platform, Not Just a Practice

The mortgage industry is experiencing a major shift, with AI-driven mortgage lending projected to hit $10.4 billion by 2027, growing at an impressive CAGR of 23.5%. This rapid growth presents a unique opportunity for lenders to maximize their IMB Value ahead of potential acquisitions.

AI Workers are revolutionizing traditional operations by transforming them into scalable, intellectual property-rich platforms that attract buyers. By automating repetitive tasks and enabling advanced analytics, you’re not just streamlining processes – you’re creating intellectual assets that hold long-term value [22].

Generative AI in banking is also on track to reach $64.03 billion by 2030, offering IMBs a chance to boost EBITDA, lower operational costs, and improve risk management accuracy – all factors that can drive premium valuations [22].

The adoption of AI is accelerating quickly – 30% of lenders already use it, and this figure is expected to climb to 55% by 2025. This creates a small but critical window for IMBs to gain an edge before AI becomes the industry standard [21]. Adapting your operations now isn’t just a choice; it’s becoming a necessity in a rapidly evolving market.

By leveraging AI Workers, you can move from a people-dependent business model to a technology-driven platform. This shift doesn’t just improve efficiency – it enhances your EBITDA, increases valuation multiples, and unlocks significant post-acquisition potential.

The choice is clear: you can continue operating as a traditional practice with standard market valuations, or you can evolve into an AI-powered platform that commands higher premiums. IMBs that make this transition today will be the ones best positioned to achieve the highest returns when the time comes to exit.

FAQs on Building IMB Value

Can AI increase IMB value for acquisition?

In a word, yes. AI Agents and Workers enhance the value of an IMB by cutting costs while maintaining productivity, which directly increases profit margins. They also retain institutional knowledge, helping to safeguard your operations and reduce reliance on employee turnover. By ensuring consistent and repeatable processes, AI Workers build trust with potential buyers and create scalable IP assets that are highly attractive during acquisitions.

These digital team members transform your business into a tech-powered platform, boosting EBITDA and raising the valuation buyers are willing to consider. They not only improve operational efficiency today but also lay the groundwork for a smoother and more lucrative acquisition in the future.

What are the first steps for an IMB to start using AI Workers in their operations?

The first step isn’t technical—it’s philosophical. IMBs must shift from viewing AI as task automation to seeing it as strategic infrastructure. When properly architected, AI Workers don’t just reduce headcount—they encode your institutional knowledge, enhance decision-making, and create scalable, ownable IP.

To begin, partner with a team that specializes in directive AI architecture—builders who understand workflows and can translate operational nuance into intelligent, self-improving digital employees.

To derive best practices from across industries, consider a vendor that has experience across payments, manufacturing, capital markets, and other financial services verticals.

Rather than start by automating a task, identify processes and workflows that, if scaled and preserved, would materially impact your margin or valuation.

The real opportunity isn’t limited to efficiency. It’s creating a workforce that doesn’t walk out the door and gets more valuable with every loan cycle.

How do AI Workers reduce dependency on key personnel during an acquisition?

AI Workers play a crucial role in minimizing dependence on specific individuals by capturing institutional knowledge and automating essential workflows. They take manual tasks and turn them into repeatable, scalable processes, ensuring operations run seamlessly, regardless of who is on the team.

This approach not only enhances business continuity but also reduces risks tied to employee turnover. For potential buyers, this creates a sense of stability and reliability, making your business more appealing and secure during acquisition discussions.