The Agent Factory for the Mortgage Industry

AI workforce solutions that make mortgage & servicing operations predictably profitable & efficient.

SELF-FUNDING PARTNERSHIP ENSURES ROI

We Contractually Guarantee ROI.

No risk. No upfront investment.

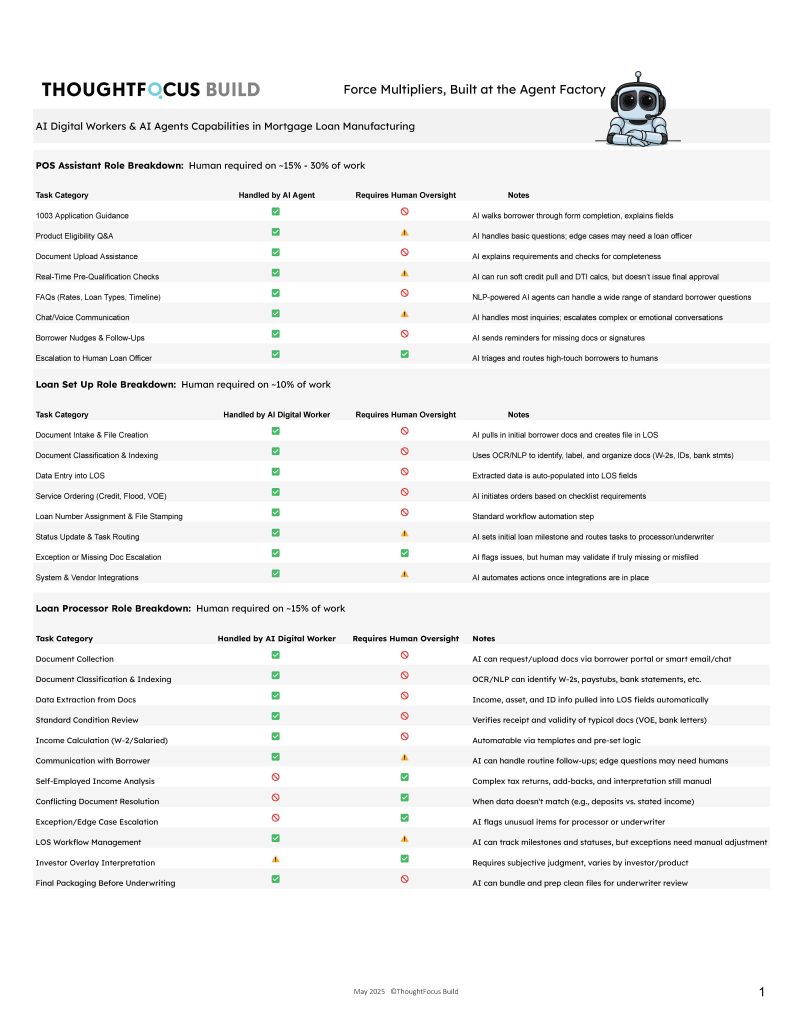

Mortgage Loan Origination Overview

A strategic review of roles that AI Workers can effectively augment or replace in mortgage loan origination.

Approximately 65%–75% of tasks in the loan origination process—from pre-application to post-close QC—can be automated using AI Workers.

Human expertise remains essential for the ~25%–35% that involves strategic judgment, borrower trust, regulatory interpretation, and resolving edge-case scenarios that AI cannot yet reliably manage.

| Role | AI Capability | Human Oversight |

|---|---|---|

| Loan Officer / Mortgage Consultant Notes: AI can prequalify leads, analyze credit, and suggest products. Human interaction is vital for trust-building and final recommendations. | ⚠️ Medium | ⚠️ Medium |

| Loan Processor Notes: Document collection, verification, and pipeline tracking can be automated with AI workflow tools. | ✅ High | 🚫 Low |

| Mortgage Underwriter Notes: AI can automate DU/LP comparison, income calculation, and guideline checks. Human judgment still needed for edge cases and risk evaluation. | ⚠️ Medium | ⚠️ Medium |

| Credit Analyst Notes: AI can analyze credit reports, calculate DTI/FICO metrics, and identify red flags quickly. | ✅ High | 🚫 Low |

| Appraisal Coordinator Notes: Order management, appraisal intake, and basic QC can be done with AI-integrated platforms. | ✅ High | 🚫 Low |

| Disclosure Desk / Compliance Specialist Notes: AI can generate initial disclosures and monitor timing. Human oversight is needed for TRID/RESPA edge cases. | ⚠️ Medium | ⚠️ Medium |

| Mortgage Closer / Closing Coordinator Notes: Document prep and audit checks are automatable. Final doc reviews and complex title/escrow issues need human checks. | ⚠️ Medium | ⚠️ Medium |

| Funding Specialist Notes: AI can manage fund wire instructions, doc matching, and balance verification. | ✅ High | 🚫 Low |

| Title Review Specialist Notes: AI can surface standard encumbrances and verify title history, but humans are needed for exceptions or legal interpretations. | ⚠️ Medium | ⚠️ Medium |

| Post-Close QC Analyst Notes: AI can execute investor checklists, identify defects, and produce exception reports. | ✅ High | 🚫 Low |

| Mortgage Document Specialist Notes: AI can handle indexing, naming, and filing of closing and post-close files. | ✅ High | 🚫 Low |

| Pre-Underwriting Analyst / Setup Specialist Notes: AI can extract and validate borrower data, prep files for underwriting, and flag missing items. | ✅ High | 🚫 Low |

AI Workers for Mortgage Origination

A role-by-role assessment of Mortgage Origination functions and the extent to which each can be replaced or augmented by AI Workers.

Mortgage Servicing Overview

An evaluation of key mortgage servicing roles and their potential for AI Worker replacement or augmentation.

Approximately 60%–70% of tasks across Servicing can be automated with AI Workers and workflow tools.

The remaining 30%–40% requires human oversight in areas involving judgment, negotiations, strategy, or legal nuance.

| Role | AI Capability | Human Oversight |

|---|---|---|

| Payment Processing Specialist Notes: Tasks such as collecting payments, posting transactions, and updating ledgers are well-suited for automation through rule-based systems and OCR-enhanced platforms. | ✅ High | 🚫 Low |

| Escrow & Tax/Insurance Administrator Notes: AI can manage calculations, escrow analysis, and disbursements; humans still needed for exception handling and communication. | ⚠️ Medium | ⚠️ Medium |

| Customer Service/Call Center Representative Notes: Chatbots can handle routine inquiries (balance, payment dates); escalation required for complex cases. | ⚠️ Medium | ⚠️ Medium |

| Loss Mitigation Specialist Notes: AI can pre-screen eligibility and simulate workout options; humans required for negotiation and empathy. | ⚠️ Medium | ✅ High |

| Default/Fraud Analyst Notes: AI can detect delinquencies and flag fraud patterns, with human oversight for investigation. | ✅ High | 🚫 Low |

| Foreclosure Specialist Notes: AI can detect delinquencies and flag fraud patterns, with human oversight for investigation. | ⚠️ Medium | ✅ High |

| Policy & Compliance Writer Notes: AI can draft policy updates based on regulation changes; humans review and ensure legal validity. | ⚠️ Medium | ⚠️ Medium |

| Investor Reporting/Servicing Rights Analyst Notes: AI can compile servicer metrics, produce MSR valuations, and format report packages. | ✅ High | 🚫 Low |

| Master/Primary Servicer Manager Notes: Strategic oversight and decision-making require human leadership. | 🚫 Low | ✅ High |

| Special Servicer for Defaulted Loans Notes: AI assists in flagging defaults and defaults workflow, but human expertise is required for high-touch loss resolution. | ⚠️ Medium | ✅ High |

| Loan Administration Coordinator Notes: Administrative duties—document management, record-keeping—are readily automated. | ✅ High | 🚫 Low |

| Customer Retention/Cross-Sell Specialist Notes: AI can surface cross-sell opportunities; personalized relationship management still needs humans. | ⚠️ Medium | ⚠️ Medium |

AI Workers fill roles from prequal to post-close QC, and loan transfer to servicing.

CUSTOMER USE CASE: BACKGROUND SCREENING COMPANY

~91% reduction on human staff reliance

More than 240,000 manual hours stripped from the adjudication process yields immediate $2.4m savings.

ready to make your operations predictably profitable?

Let's discuss possibilities.

We’ll reach out to schedule some time for a demo and discussion.